With the local real estate market in the midst of a multi-year freefall and local housing prices reflecting the ongoing tumble, Charlottesville Assessor, Roosevelt Barbour, Jr., recently issued utterly inconceivable figures indicating that Charlottesville residential property values had declined by only .14% from the previous year.

Although Barbour reluctantly disclosed that his office does not use “foreclosure” sales in assessment calculation, to the discerning, his measly .14% downward tittle conveys an overly “rosy” picture of an ugly real estate reality.

In order to obfuscate the “voodoo” valuation and manipulative math used to justify home assessments inflated above actual market values, Barbour and his bureaucratic-Democratic co-conspirators have divided a city of only ten square miles into 47 residential and 18 commercial “neighborhoods” for purposes of assessment.

Barbour’s convoluted 2011 market interpolation shows no valuation change from 2010 in 25 of the city’s 47 neighborhoods—and 9 neighborhoods with increased values of up to 10%! Thus, according to the Charlottesville Assessor, 72% of assessed Charlottesville residential housing (i.e. 34 of 47 “neighborhoods”) showed either no decrease or an actual increase in value year-over-year: an absurd determination at best.

Following last year’s humiliating exposé of the Charlottesville Assessor’s gross incompetence and/or misfeasance, Mr. Barbour and his executive overlings have devised a new tactic to protect aggrandized property valuations from scrutiny and to thwart citizen assessment appeals: intimidation.

A February 2011 written appeal of several overinflated Charlottesville residential assessments was met by the following email admonition from Mr. Barbour:

From: “Barbour, Roosevelt” <Barbouro@charlottesville.org>

Date: February 9, 2011 09:59:46 AM EST

Cc: “Brown, Craig”

Subject: RE: Assessment AppealsI am replying to your e-mail to acknowledge my receipt. Please go online to Charlottesville.org to obtain the assessment appeal forms, complete, and return to this office. We will then continue the review process.

Thank you, R.W.Barbour, Jr., RES

Sure, “assessment appeal” forms…how difficult could that be? Plenty!

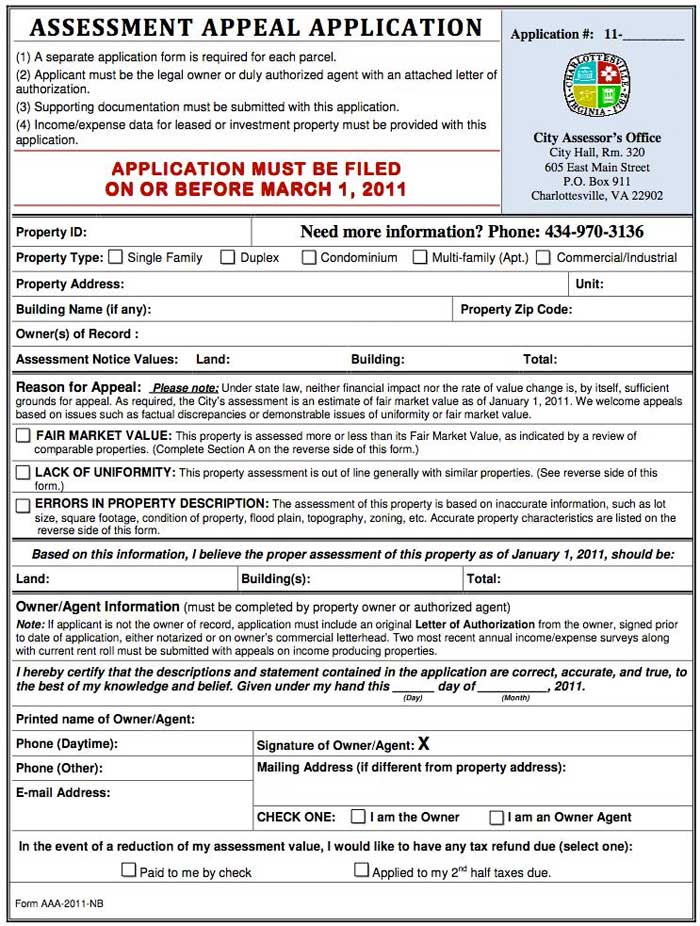

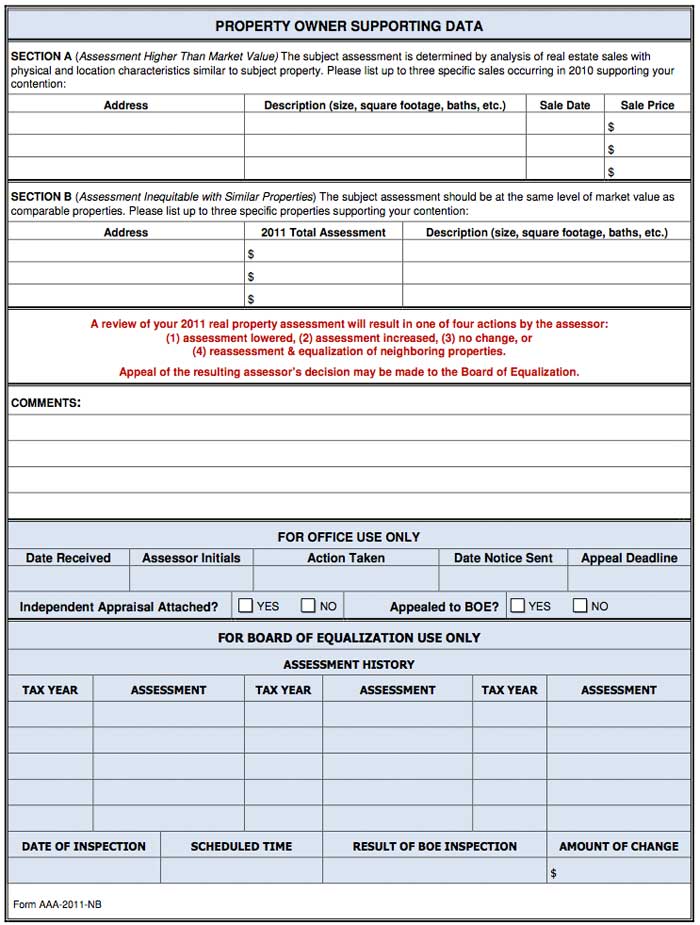

The overwhelming technicality and complexity of new Charlottesville Assessor’s Assessment Appeal Application might cause even a seasoned real estate veteran to withdraw from the appeal process, but the average citizen doesn’t stand a chance against this “form.” It briefly can be summarized as follows:

- It is a labyrinth of confusing checkboxes and jargon-laden information demands.

- It requests detailed property information and comparable sales analysis that is beyond the common knowledge and the individual capability of most citizens.

- It burdens citizens to establish the value of their own property, rather than relying on the assessor to perform his duties competently.

- It forces citizens to disclose valuation research to the assessor with no guarantee of information reciprocity from the assessor’s office.

- It contains explicit threats that the appellant’s or neighboring property assessments may be increased as a result of the appeal.

- It unnecessarily demands sensitive tax information (income/expense statements) from rental property owners.

- It clearly is designed to discourage further inquiry.

Although not referenced on the city’s “Notice of Assessment Change” sent annually to all Charlottesville property owners, Barbour’s terse email response and the assessment appeal process information posted on the city’s web site (and copied below) appear to mandate completion and submission of the Assessment Appeal “form” in order to formally establish an appeal, to wit:

City of Charlottesville Assessment Appeal Process

Each year, all property owners, or their duly-authorized agent, may appeal our valuation of their property by requesting a review of their assessment. Under state law, neither financial impact nor the rate of value change is, by itself, sufficient grounds for appeal. As required, the City’s assessment is an estimate of fair market value as of January 1 each year, based on property sales for the previous calendar year. We welcome appeals based on issues of factual discrepancies in property description or features, demonstrable issues of uniformity of value within a neighborhood, or fair market value.

The first step in this process is to file an Assessment Appeal Application, requesting an assessor review. Assessment Appeal Application forms are available on the City Assessor’s website, in Room 320 of City Hall, or at any of the City’s local libraries. After filling out this form, you may initiate your request by mailing your request to City Assessor, City Hall – Rm. 320, PO Box 911, Charlottesville VA 22902. You may also stop by Room 320 in City Hall to drop off the request in person.

Your appeal for a review of your assessment must be filed after January 31st and delivered to our office by one of the above means on or before March 1, 2011. Appeals should be made in writing, including the City’s Assessment Appeal Application, a Letter of Authorization if the appeal is being made by an owner’s agent, and any other supporting documentation that is appropriate. This documentation must include the reasoning behind the appeal and evidence that the most recent assessment (1) exceeds true market value, (2) is substantially inequitable to similar properties within your neighborhood, or (3) is not equitable based on factual discrepancies within our records, such as difference in square footage, difference in acreage, or improvement condition. [sic]

As the requested process appeared to be newly implemented, an inquiry was made of City Attorney Craig Brown regarding the necessity of providing the “form” Barbour (and the city web site) strongly implied was mandatory. Brown responded:

“…the forms are not mandatory and did not result from a change in the law.” [emphasis added]

Brown further cited the real estate assessment appeal process as set forth in City Code (and with references to applicable State Code):

(a) Whenever there is a reassessment of real estate, or a change in the assessed value of any real estate, notice shall be given by the city assessor, by mail, to each property owner, as shown by the land books of the city.

State law references: Similar provisions, Va. Code § 58.1-3330.

(b) Any person aggrieved by an assessment made by the assessor of real estate shall have the right to a hearing before the city assessor, upon filing a written request with the assessor within thirty (30) days after mailing of the notice of such assessment or of a change in such assessment. Following this hearing the city assessor shall set forth his ruling in writing.

(c) After the hearing before the city assessor, if the person is still aggrieved by the assessment, such person may apply to the board of equalization for a hearing. Such application shall be in writing and shall be filed with the board of equalization within thirty (30) days after the ruling issued by the assessor following the hearing.

(1) The board of equalization shall sit at and for such time(s) as may be necessary to discharge its duties. Public notice of each sitting shall be given in accordance with the requirements of § 58.1-3378 of the Code of Virginia.

(2) The board of equalization shall hear and give consideration to complaints and shall adjust and equalize assessments in accordance with the standards set forth within § 58.1-3379 of the Virginia Code; provided, however, that the board may adopt such rules and regulations as it deems proper to facilitate and simplify the presentation, consideration and deliberation of any case brought before it.

(3) The board of equalization shall keep minutes of its meetings and enter therein all orders made and transmit promptly copies of such orders as relate to the increase or decrease of assessments to the taxpayers whose property is subject to such orders and to the commissioner of the revenue.

(d) No fee or charge shall be assessed against the owner because of a hearing pursuant to either subsection (b) or (c) of this section.

(Code 1976, § 10-17; 1-5-04(2), § 3)

State law references: Similar provisions, Va. Code §§58.1-3378–58.1-2284.

Sec. 30-74. Right of appeal to circuit court.

Any person aggrieved by any assessment made by the assessor of real estate or the board of equalization may, after a hearing before the assessor of real estate and after a hearing before the board of equalization, apply for relief to the circuit court in the manner provided by Code of Virginia, section 58.1-3984.

(Code 1976, § 10-18)

Barbour’s “Assessment Appeal Application” clearly is not referenced in Charlottesville City Code that delineates the process, nor, according to the City Attorney is it mandatory.

Q. So, why would City Assessor Roosevelt Barbour initiate such a process and then pretend that it is mandatory?

A. To intimidate citizens from even considering filing a real estate assessment appeal.

And intimidate, it does. Figures obtained under a Freedom of Information Act request of the Charlottesville Assessor’s office reveal that the number of residential assessment appeals fell precipitously this year, plummeting from 311 in 2010 to 206 in 2011—a 34% drop.

From all indications, it appears that Barbour’s authoritative bullying was, in fact, auspiciously intimidating to average citizens contemplating assessment appeal. And from the city’s perspective, it certainly was considered a rousing success.

Virginia’s system of real estate assessment is convoluted in nature and corrupt-to-the-core in practice. In “mandating” the provision of information that is not actually required by law, the Charlottesville Assessor has upped the ante in both convolution and corruption. While Charlottesville’s 2011 assessments are demonstrably unworthy of the public trust, the same can be said of the Charlottesville Assessor and his newfangled Assessment Appeal process.

See Barbour’s convoluted “mandatory” assessment appeal forms:

This system was refined when Overrun O’Connell was running things. Do not expect any changes now. Maurice Jones does not know how to change it and Council certainly doesn’t want him to. Meanwhile property continues to sit on the market in the city until the owner gets tired and takes it off the market, unsold.

Rob, Please hold that thought about how Barbour has “shaved” the City of Charlottesville into 47 residential and 18 commercial neighborhoods. You were

quoted in CVILLE about Republicans in the City not running

for City office until an electoral ward system is created.

Correct me if my memory is false. If I am correct, couldn’t the City Democrats, if they so chose, create

political ward boundaries in the spirit of Roosevelt “the

Property owner’s bank account shaver” Barbour? On the other hand, the prospect of 47 City Councillors might translate into a non-City Democrat winning a seat.

Gary, your memory serves you well. Democrats could initiate a charter change if they chose to. They also could change the city’s elections to “instant runoff” voting, as they are using again this year for their own firehouse primary.

What’s good for the Party is good for the city, right?

I’m going to investigate the sale price to asessesed values in Charlottesville by a monthly report (I work at Court square so doing one month on a lunch hour takes about a week). Sam’s report for deeds recorded in Jan 2010.

There was one big commercial recording (111-115 West Main St.) it sold for 1.76% less than the assessed value.

There were 15 residential sales recorded to base a figure on.* The total sales were 8.69% lower than the assessed value.

* deeds not counted:

* any City of C-ville deed to X (there would not be an assessed value)

* 5 trust deeds (X to X trust or vice versa was not counted, they ususally don’t give you a sale price, only one out of 5 did)

* 2 sales where the assessed value could not easily be determined at sale time (there is only so much time I can put into it so these two not counted)

* 1 new house sale where the lot was obviously vacant the year before not counted

* 1 habitat for humanity sale so assessed value not given, and that person (by checking the 2011 assesed value) apparently doesn’t own the house any longer.

The largest sale above assessed value was on St. Ann’s Road. (540K sale price vs. 481 assessed price) The largest below was a Condo (Yellowstone Dr.) assessed at 166k+ and sold for 96K, and a house in Orangedale assessed at 157k+ sold for 82k+. Both Gaffney homes and Southern development sold homes in new developments for less than assessed value in Jan 2010.

Is anybody really surprised that the assessments are inflated? City property taxes are already about a 1/3 higher than the county. To support the level of spending they have to inflate the assessments because that is a “hidden” tax increase. If they raised the property tax rates all hell would braek loose.

I corrected a mistake and looked up the ones the attorneys didn’t put an assessed value on.

In Jan 2010 there are 18 recordings one could base a figure on for City residential sales.* 1 sold for the exact assessed price, 5 sold for more, and 12 sold for less than assessed. Total dollar sales were 3,864,500 for the 18 sales. Total assessed value by the City was 4,328,700 being a difference of 464,200. 464,200 X 100 divided by 3,864,500 is 12 percent. 464,200 x 100 divided by 4,328,700 is 10.7%. (The Habitat house has not been resold or flipped)

* 5 person to a trust or vice versa not counted, no deeds where the City (1) or Habitat was a party (1), no deeds where the land was vacant the year before etc, no deeds of gifts etc.

In Feb 2010 there were 26 “bargain and sale” deeds recorded in Charlottesville. Five cannot be counted (2 person to a trust, 1 habitat for humanity sale, 1 person to L.L.C., and 1 no building the year before). So 21 sales to base a figure on. 7 sold for more than assessed price, 14 for less. Total Sale price was $5,126,300. Total Assessed value was 45,871,100. The difference being $744,800 total sales less than assessed value or 12.69% to assessed or 14.52% to sales. The highest sale above assessed value was a house on Evergreen Ave. One of the best bargains was a sale on Banbury St. for $145,000 (from Fannie Mae)for a house assessed at $235,800. The person who bought the Habitat home for $185,000 would have probably been better off buying the home on Banbury for $40,000 less.

In March 2010

2 Commercial sales Assessed of both: 4,490,400 vs. 3,650,000 or 840,400 less or 18.71%. One of these was owned by the City (yet it has an assessment on the deed) and they sold it to Region 10 for about 300K less than the assessment0

33 Residential (that could count) total assessed was 8,600,700 and sales were 8,074,390 or 526,310 less or 6.52%

20 sales going to a trust or LLC and tax exempt, 2 new constructions, 3 vacant lots (which did sell for about twice their assessed value.

Best above Assessed price: Meadowbrook heights Rd and 1305 and 1305 1/2 Cherry (which might be apartments)

Worst was a house on Hinton, 1800 Jefferson Park Condo,and a Condo in “The Randolph”.

Another subtle point is that, while the assessor does not consider foreclosure auctions to be valid sales (which they should be because they are reflective of the market), they do consider the previous inflated sale of those same houses when they sold during the bubble to be valid sales—-even though nobody actually paid for them. I.e. somebody agreed to buy a house for $300K and never follows through on paying for it. The assessor says this is a valid transaction. When the house is foreclosed on and re-sold (auctioned) at a more realistic/marked price (say $200K), the assessor decides this isn’t valid.