Following an embarrassing sales-tax collection debacle that enriched Charlottesville City at the expense of Albemarle County, the Albemarle Truth in Taxation Alliance has uncovered a new regional tax inequity, this time involving misappropriated local utility taxes.

While the county caps monthly utility taxes at $4, an unknown number of Albemarle County utility customers have been billed at the Charlottesville City rate—which is not limited— resulting in significantly increased bills.

Albemarle County government is aware of the problem and is working on a fix. In the meantime, however, it is not clear how individual victims of the unjustified taxation will be compensated. Also unknown is how inter-jurisdictional remediation will be resolved, as Charlottesville City appears to have been unjustly enriched at the expense of Albemarle County.

Read the Albemarle Truth In Taxation Alliance press release:

ATTA Identifies Improperly Collected Utility Taxes

County residents paying excessive taxes to city for years

Charlottesville, VA — January 24, 2011

ATTA research indicates Albemarle residents may be unnecessarily paying higher utility taxes than allowed by the county, and that their utility tax payments could be ending up in Charlottesville City tax coffers instead of going to the County of Albemarle.

Regarding sales taxes, Albemarle County’s 2008 Resources Management Review identified “the State (of Virginia) Department of Taxation does not make great efforts to distinguish between localities when distributing the one cent local sales tax.” The result was county taxes being sent to the city; Albemarle County hired an auditor to recapture the estimated $500,000 to $1M per year.

Now, it appears the same “glitch” in the way utility taxes are collected and distributed based on zip codes by some utilities, may be causing the same problem.

Approximately 60% of county homes have a “Charlottesville, VA” mailing address. Over the years, local utility providers seemingly have assigned many of those residences as located in Charlottesville City rather than Albemarle County. As a result, those utility taxes have been sent to Charlottesville, for many years, it appears.

Compounding the problem is the cap of $4 per month per utility that Albemarle has authorized. Charlottesville, however, has no such dollar tax limit.

“Instead of a maximum of $4 per month tax on my electric bill going to the county, several times more than that is going to the city,” indicated ATTA leadership member Bob Short, who originally identified the issue. “ATTA originally alerted Albemarle staff to the issue, and they have assured us they are addressing the issue. We are currently working with the county to quantify the issue and determine how best to take corrective action,” he continued.

County residents can you tell if they are paying too much utility tax and if that tax is going to Charlottesville instead of Albemarle. If they have a “Charlottesville, VA” mailing address and the tax portion is listed as something like “County Tax: $4.00,” then their taxes are being collected properly.

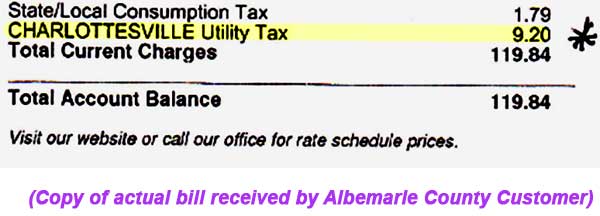

But if their bill indicates “Charlottesville Utility Tax: $<an amount higher than $4>” then they are likely a victim of this problem. Here is an example of a November 2010 electric bill for a home in Ivy, Albemarle County–the bill should indicated a $4 county tax, not a $9.20 city tax.

ATTA has been assured by staff at the Finance Department that they are working on the problem.

But until then, ATTA asks the following questions:

- For how long has the improper collection of our utility taxes been going on?

- How much of our tax dollars have improperly been sent to Charlottesville during that time?

- What specific actions is the county currently taking on this issue?

- Are reparations for past improper tax collections appropriate? Charlottesville has apparently benefited from what could be a significant amount of tax revenue over the years. In the interest of fairness, some form of compensation may be appropriate.

If it is determined the amount of improperly collected and distributed taxes is significant, Charlottesville could potentially return our tax dollars by deducting a portion of that amount from the annual Revenue Sharing Agreement payment. For example, deducting 10% of the excess amount over a ten-year period.

County residents are also encouraged to call their supervisor and encourage them to accelerate the county’s work on this important tax issue.

I think that the County should not have to underwrite the City!

I do not know about electric bills, however, county residents buy their heating gas from the city. We city residents subsidizes the extension of the city’s gas lines into the county with the hope that eventually we will get enough county customers that our gas bills will not rise. It has not happened yet. As long as the county residents are buying from ACSA they should expect to pay county prices and taxes. As long as they are buying from the city, they should expect to pay city prices and taxes. When the city and county had different meals and lodging taxes they paid the city’s tax rate when in the city and the county’s tax rate when in the county. The county can not expect to govern the relationship its residents have with the city. After all we city residents have been subsidizing the county’s treated water for 47 years to the tune of millions of dollar and is about to give the water works over to them. We have also been subsidizing the county’s sewer for years, too.