Previously, we documented Charlottesville’s outrageous residential over-assessments wherein scores of City property owners have been paying dramatically higher real estate taxes than they should be—thanks to a partially corrupt, partially inept assessment operation, headed by Roosevelt Barbour (in collusion with the Charlottesville City Manager’s office).

But today’s announcement of the Charlottesville Ice Park’s completed sale should trigger righteous indignation and even more so, outrage, by Downtown Charlottesville commercial property owners.

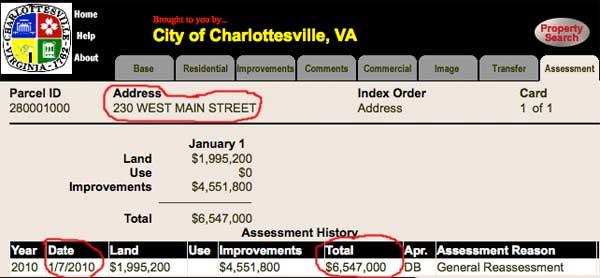

Assessed in January 2010 for $6.55 million, the Ice Park was sold in July 2010 for $3 million—this represents an over-assessment of $3.55 million or of nearly 118% of the sales price.

What this means is that previous owners, Bruce and Roberta Williamson, were assessed taxes of $62,196 in 2010 (.95 per $100), when the property’s true value, as determined by the amount a willing buyer would pay for it, yields a revised tax assessment of $28,500. The Williamsons were fleeced for an annualized amount of $33,696.

And that’s just for this year.

Charlottesville’s purposefully obtuse (and embarrassingly antiquated) online assessment records do not show assessed values for previous years (unlike Albemarle County’s superior modern system). But it does not take much imagination to believe that the Williamsons have dramatically been over-assessed (and, thus, overtaxed) for many of the years in which they owned the downtown rink.

And what of other Charlottesville commercial property?

The Virginia real estate taxation system is rigged in such way that property owners seldom appeal their assessments. Mr. Barbour and his city hall cronies know that many property owners equate higher assessments with greater market value. Thus, owners are loath to request reduced assessments. Add to that fear the assessor’s sometimes tacit, sometimes overt admonition that appeals may lead to an even higher assessment than originally was calculated. Through these various factors, the iniquitous system effectively neutralizes the vast majority of conceivable complainants.

The “higher assessment = more value” reasoning is easily undermined by examining the fate of the Ice Park. It was listed for sale at $4.1 million, dramatically below its 2010 assessed value. Yet, ultimately, the property was unable to fetch even 75% of the asking price. Fat lot of good the bloated assessment did to “increase” the value of that property. And the same could be extrapolated to other over-assessed commercial properties in Charlottesville.

Though downtown Charlottesville continues to languish with shuttered stores and barren buildings, the City Assessor always gets his dollar.

The Williamsons got fleeced, but the Barbour is laughing all the way to the bank.

[…] real property as high as possible, even if the market thinks differently. Rob Schilling, a local talk radio host in Charlottesville, Virginia, explains how the recent sale of […]

[…] This post was mentioned on Twitter by Ken Kaplan and Eric May, Need Office Space. Need Office Space said: Fleeced by the Barbour 2: Charlottesville's commercial real estate …: Yet, ultimately, the property was unable t… http://bit.ly/bcwdcD […]

[…] interest to value real property as high as possible, even if the market thinks differently. Rob Schilling, a local talk radio host in Charlottesville, Virginia, explains how the recent sale of a local ice […]

[…] in the midst of a multi-year freefall and local housing prices reflecting the ongoing tumble, Charlottesville Assessor, Roosevelt Barbour, Jr., recently issued utterly inconceivable figures indicating that Charlottesville residential […]

It may interest Mr. Schilling to know that Acme Ice Company did not request a change in assessment, as permitted by city law, because it made sense to pay taxes at that rate for us. Mr. Schilling is entitled to his opinion, but it might have been polite to ask first if we felt cheated by the system.